US–China Trade War 2.0: Tariffs, Technology, and Global Markets in 2025

The U.S.–China trade war enters a new phase in 2025, reshaping technology, supply chains, and investment flows.”

The U.S.–China rivalry has shifted decisively. What once revolved around steel and soybeans is now a contest over chips, batteries, and the very architecture of the global economy. Washington’s decision to slap fresh tariffs on semiconductors, EVs, and green-tech inputs has been met with a sharp response from Beijing, which tightened its grip on exports of rare earths and other critical minerals.

This is not a short-term skirmish. The rules of globalization are being rewritten. Higher input costs threaten to complicate central banks’ already delicate disinflation efforts, while investors must price in structural changes to supply chains that had, for decades, delivered cheap goods and steady margins.

Highlights:

15–25% U.S. tariffs on AI hardware, EVs, and solar inputs; China retaliates with export limits on gallium, graphite, and rare minerals.

Conflict tilting from tariffs on goods to a contest over technology and capital flows.

Inflationary pressures linger: +30–50bps globally through 2026.

Commodity exporters may benefit, while multinationals face rising costs and thinner margins.

From Trump’s Tariffs to Today’s Tech War

The first trade war (2018–2020) was defined by tariffs on hundreds of billions of dollars of goods. Farmers needed bailouts, supply chains bent but did not break, and markets soon turned back to monetary policy.

In 2025, the battlefield has moved. At stake is leadership in semiconductors, AI, and green-energy hardware. Washington frames new measures as protecting “economic security,” while Beijing speaks of “technological sovereignty.” This is no longer about extracting concessions but shaping the industries that will matter most in the coming decade.

Trade in Numbers

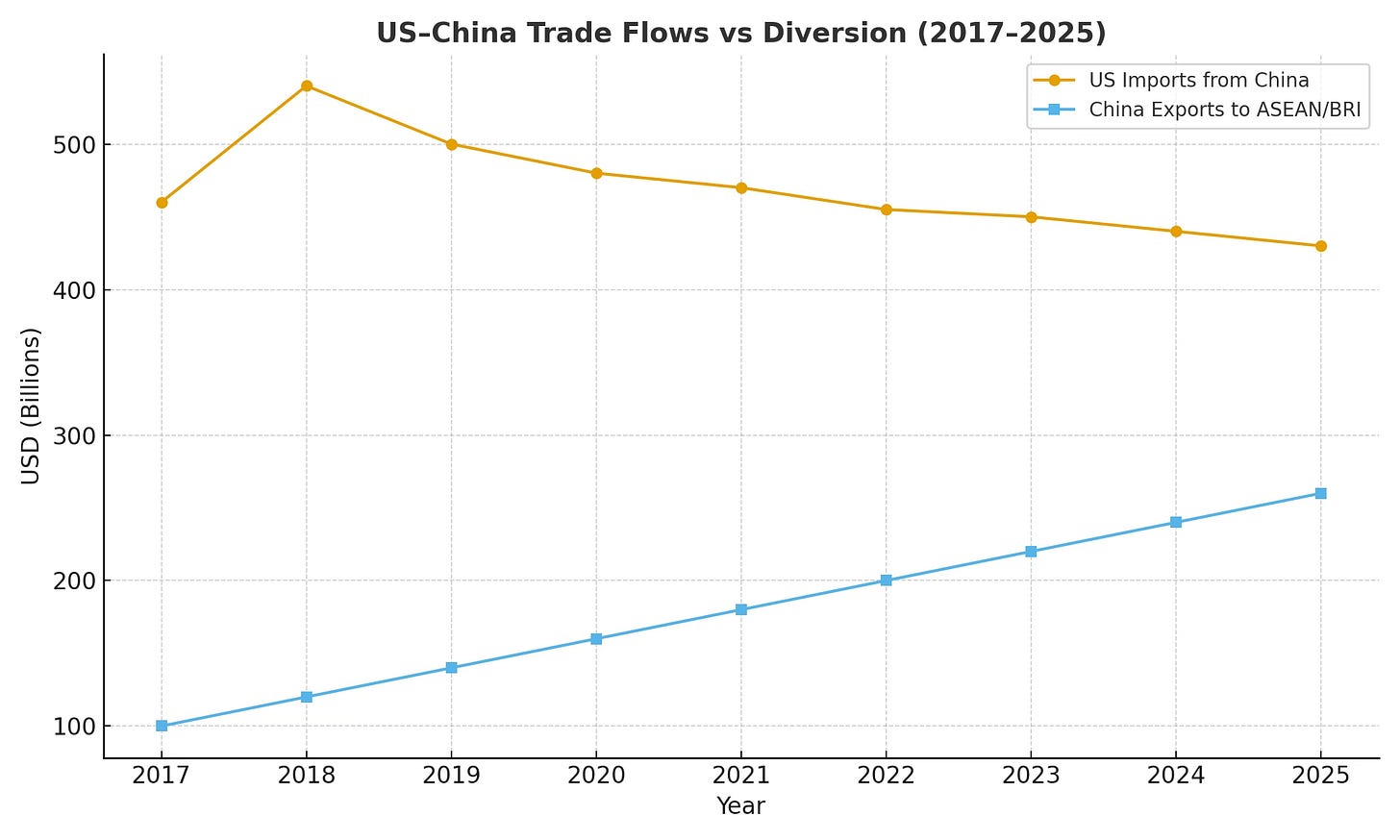

Source: FRED

U.S. imports from China peaked above $540bn in 2018, sliding to ~$450bn by 2023.

Chinese exports to ASEAN & Belt-and-Road partners have risen >20% since 2020.

Advanced chip imports into the U.S. from Taiwan/Korea are up double digits YoY.

Rare earth shipments from China fell ~18% YoY in Q1 2025.

The dollar volumes may be smaller, but the goods in play are strategic, making the macro consequences outsized.

The Technology Divide

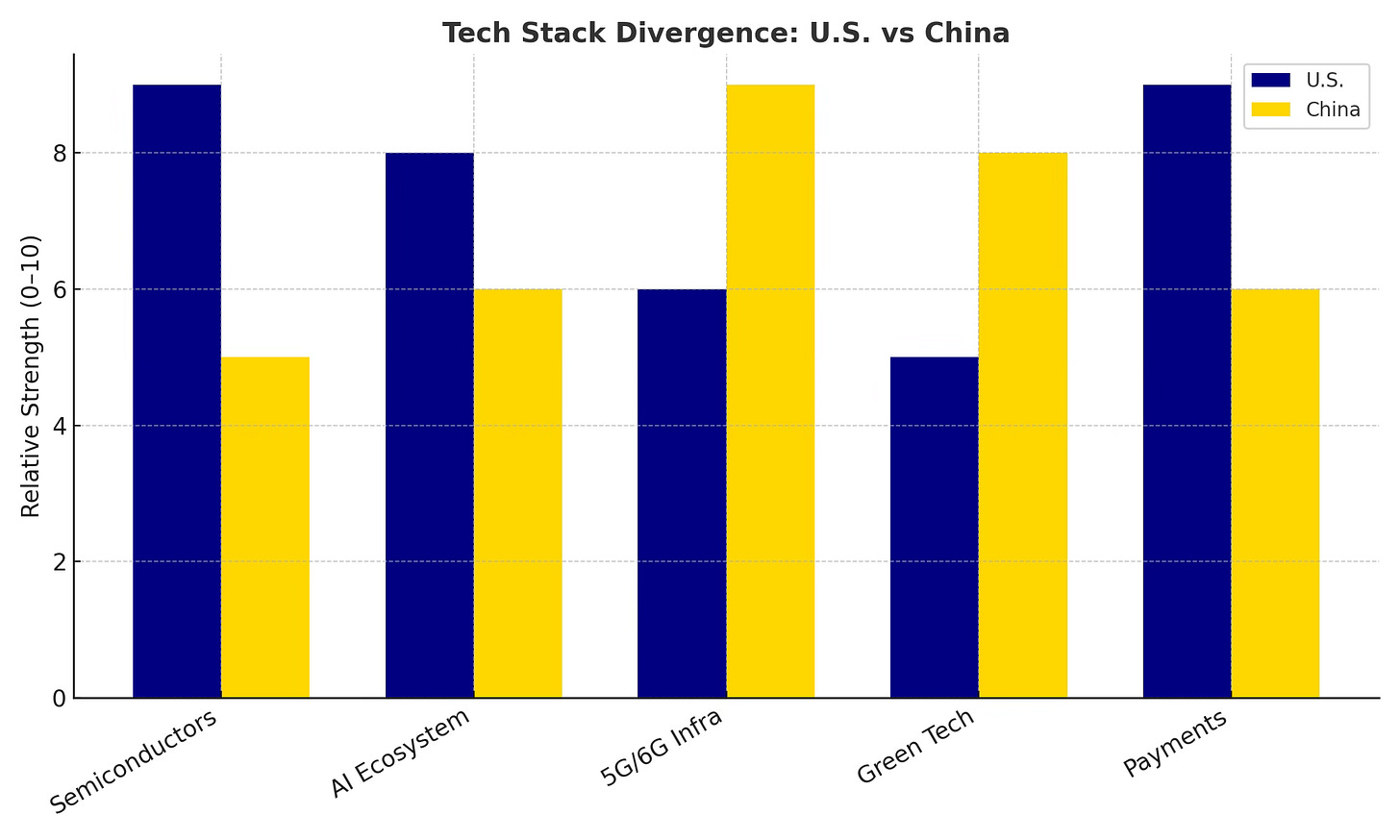

The real contest is not T-shirts or toys but the foundations of next-generation computing.

Chips: U.S. bans advanced GPUs; Beijing backs SMIC and Huawei.

AI ecosystems: U.S. venture flows into Chinese AI halved since 2022.

Infrastructure: Diverging standards in 6G, digital payments, and cybersecurity.

Source: Multiple, illustrative only

The world is sliding toward dual technology ecosystems, with multinationals forced to duplicate supply chains, compliance regimes, and R&D.

Macro and Inflation Risks

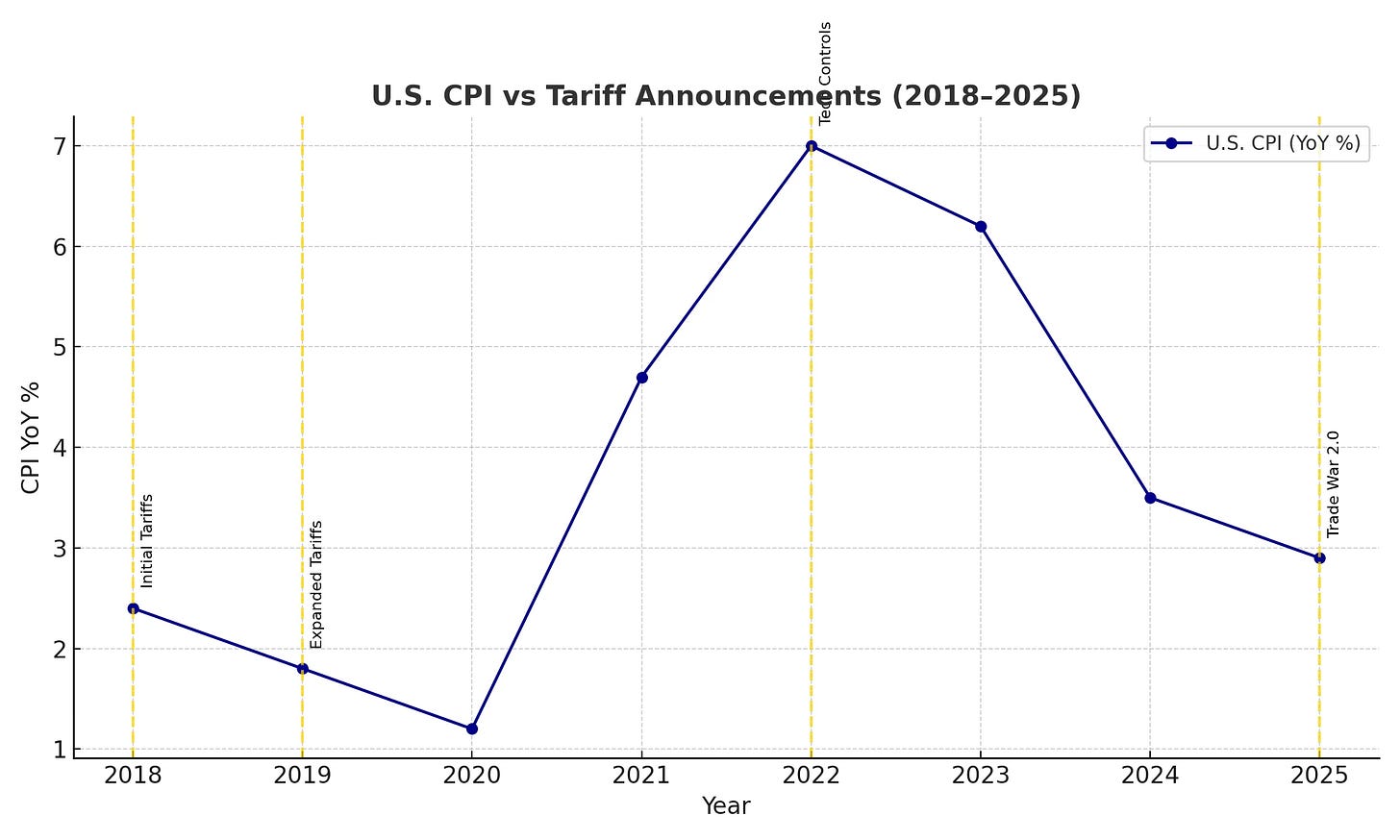

Tariffs and restrictions land just as central banks hoped to declare victory on inflation.

Import costs alone could add +0.3–0.5pp to inflation in advanced economies.

Reshoring fuels wage pressures as U.S. and EU factories scramble for labor.

Energy transition costs rise if batteries, solar panels, and minerals stay expensive.

Source: U.S. BLS CPI Databases

Powell’s “data-dependence” now means watching tariff policy almost as closely as payrolls.

Market Lens

Equities

U.S. chipmakers: revenue headwinds (20–30% exposure to China).

Industrials: short-term winners from reshoring, longer-term margin squeeze.

China A-shares: state-backed firms supported, foreign outflows intensify.

FX

USD: safe-haven bid vs. deficit risks.

CNY: gradual weakening to cushion exporters.

AUD/BRL: commodity exporters gain.

Bonds

Treasuries: stagflation risk premium vs safe-haven demand.

Corporate spreads: widening on higher input costs.

Commodities

Rare earths, copper, lithium: structural demand.

Oil & LNG: higher shipping/transport demand.

What Markets Underprice

Persistence of “economic security” as a bipartisan U.S. policy anchor.

Second-round inflation effects (wages, services).

Cost duplication across R&D, compliance, and manufacturing.

This isn’t a cycle that will end with a change of leadership. It is a rivalry.

Looking Ahead to 2026

Expect further tariff headlines as U.S. elections near.

China is accelerating RMB settlement across Belt-and-Road networks.

Investors should brace for volatility not just in equities but in the risk premia baked into FX and bond markets.

Conclusion

Trade War 2.0 is not simply a rerun of 2018. It is deeper, structural, and centered on technology. The global economy faces persistent inflationary drag, slower growth, and higher volatility.

MacroAnalytix Base Case:

Growth shaved by ~0.2pp.

Inflation +0.3–0.5pp through 2026.

Equity margins squeezed, bond premia elevated, and resource exporters favored.

Stay ahead of U.S.–China dynamics and macro market shifts. Subscribe to the MacroAnalytix Weekly Outlook and Premium Playbook for exclusive scenario analysis, charts, and forward guidance.

*Disclaimer:

All content published by MacroAnalytix — including articles, research notes, charts, dashboards, and trade ideas — is provided strictly for research and educational purposes only. Nothing contained herein constitutes financial, investment, trading, or legal advice.

Financial markets carry risk, and past performance is not indicative of future results. You are solely responsible for any investment decisions you make. Always conduct your own due diligence, consider your individual financial circumstances, and consult a licensed financial advisor before making any financial commitments.

MacroAnalytix makes no representations or warranties as to the accuracy, completeness, or timeliness of the information provided and accepts no liability for any losses or damages arising directly or indirectly from reliance on this content.